Copper Sector and Associated Contracts

The global copper sector is navigating a period of tight supply, strong demand, and heightened strategic importance, with prices expected to remain robust and volatility likely as the world accelerates its energy transition and digital transformation. Key trends include:

Strong and Sustained Demand Growth

Global copper demand is projected to grow by 2% in 2025, driven by the expansion of renewable energy, electric vehicles (EVs), digital infrastructure, and urbanization, especially in Asia. Over the long term, demand is expected to rise by 40% by 2040, with some forecasts suggesting up to 70% growth by 2050. China and India are the primary demand centers, with China alone accounting for over 50% of global copper consumption.

Supply Constraints and Structural Shortfall

Despite new mining projects (notably in the DRC, Mongolia, and Russia), mine supply growth is struggling to keep pace with demand due to declining ore grades, long permitting times, and geopolitical risks. The International Copper Study Group (ICSG) forecasts a global copper surplus in 2025 (289,000 tonnes), but this is attributed to temporary supply-side expansions and may not resolve longer-term deficits. Meeting future demand could require 80 new mines and $250 billion in investment by 2030.

Global Markets and Recent Trends

Price Trends and Market Volatility

Copper prices remain elevated due to tight physical market conditions, supply disruptions, and geopolitical tensions, particularly in the Middle East. Forecasts for 2025 suggest prices may fluctuate between $8,800 and $9,500 per metric ton, with some analysts predicting further increases if supply constraints persist.

Major trading and mining firms anticipate that the bullish trend will continue, underpinned by the energy transition and increased infrastructure investment.

Geopolitical and Macroeconomic Influences

Geopolitical tensions (e.g., in the Middle East) and trade policy uncertainties are adding risk premiums to copper prices and impacting supply chains. Monetary policy, particularly US interest rate decisions, continues to inject volatility into commodity markets, influencing investment flows and price movements.

Strategic Shifts and Industry Response

The industry is focusing on increasing recycling, developing new mining projects, and diversifying supply chains to manage risks and meet demand. There is a call for smarter trade and industrial policies to help developing countries move up the copper value chain and address supply bottlenecks.

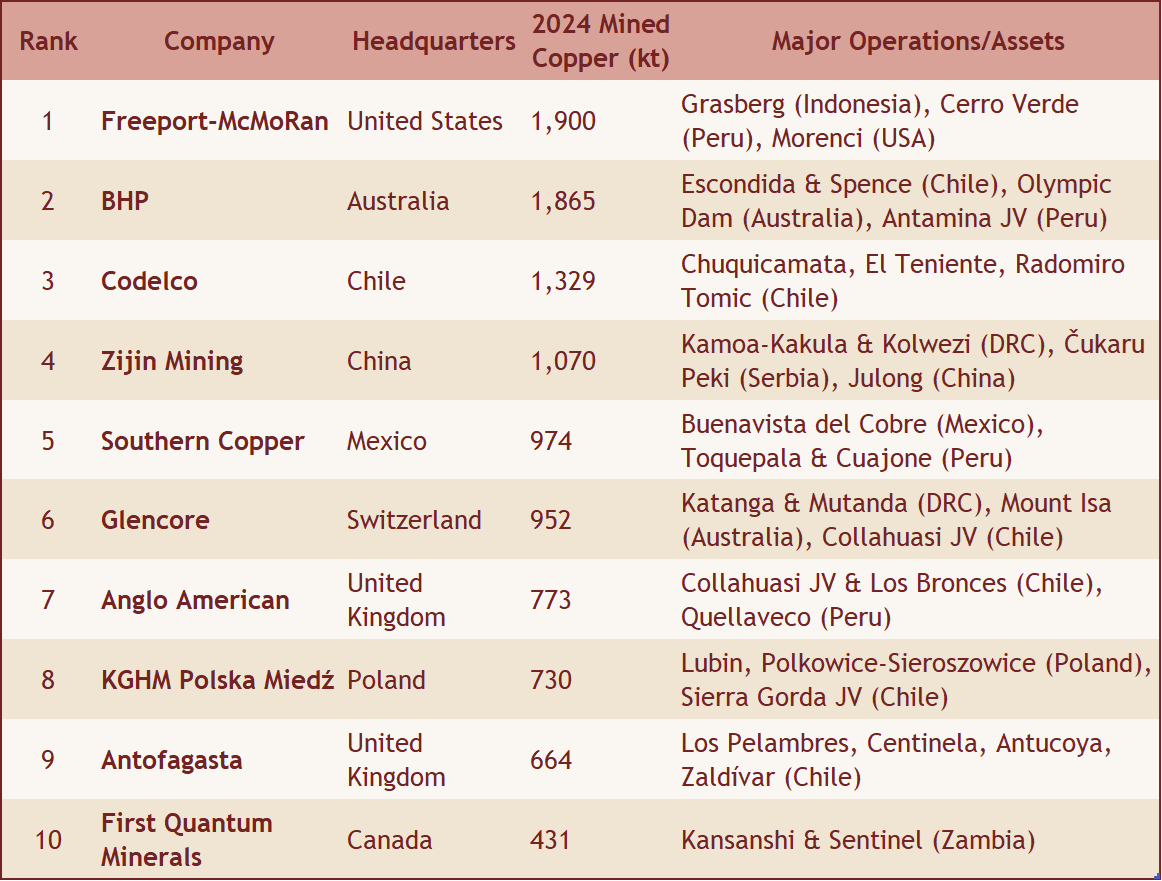

Major Global Companies in the Copper Sector

Other notable companies include China Minmetals (through MMG Limited and other assets), which would also rank among the top 10 if consolidated. Key assets, such as the Escondida mine (Chile, majority-owned by BHP), Grasberg (Indonesia, Freeport-McMoRan), and Collahuasi (Chile, Anglo American and Glencore JV), are among the world’s largest copper mines and are crucial to global supply. Glencore also stands out as the largest mining company in the world by revenue as of 2025, underscoring its significant role in the global copper sector.

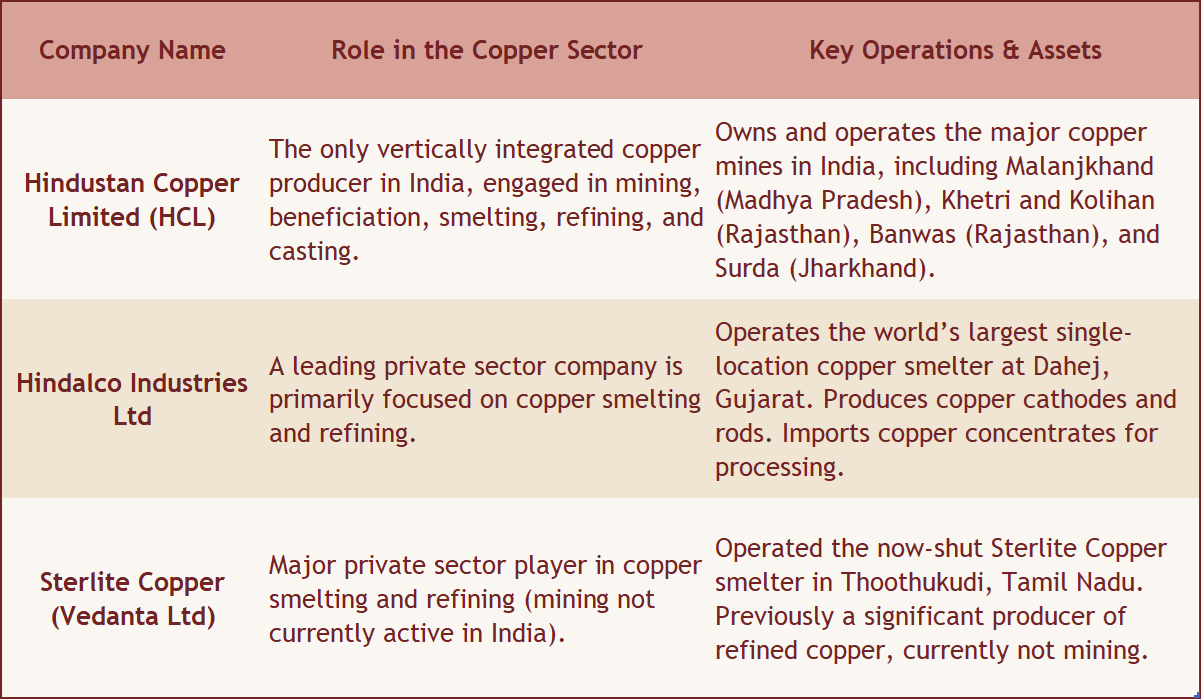

Major Indian companies in Copper Mining & Production

Hindustan Copper Limited (HCL) is the only company in India with significant copper mining operations, owning all the major producing mines (Malanjkhand, Khetri, Kolihan, Banwas, Surda). Hindalco Industries and Sterlite Copper (Vedanta Ltd.) focus on smelting and refining, utilizing imported copper concentrates as raw materials. Gujarat Mineral Development Corporation and Jagadia Copper Ltd are listed among copper-related companies, but do not have significant mining operations compared to HCL.

Types of Contracts in the Copper Sector

The copper sector utilizes several types of contracts to govern operations, procurement, sales, and project development. The major contract types include:

Mining Services Agreements (MSA) / Mining Development and Operations (MDO) Contracts

These are long-term agreements between a mining company (such as Hindustan Copper Limited) and a contractor or consortium for the development, mining, and beneficiation of copper ore. The MDO is responsible for mine development, construction, operation, and sometimes closure and rehabilitation, often for 20 years.

Such contracts may involve EPC (Engineering, Procurement, and Construction), O&M (Operation & Maintenance), and beneficiation sub-contracts.

Offtake Agreements

These contracts specify the sale and purchase of copper concentrate, cathodes, or rods between producers and buyers (such as smelters, refiners, or industrial users). Offtake agreements can be long-term (providing price stability and supply security) or short-term/spot contracts, and often reference global benchmark prices like those on the LME or COMEX.

Commodity Exchange Contracts

Copper is also traded on commodity exchanges (e.g., London Metal Exchange, COMEX) via standardized contracts for Grade A copper with defined lot sizes, quality, and delivery terms. These contracts are used for both physical delivery and hedging price risk.

Job/Works Contracts

These are agreements for specific services or jobs (other than civil works), such as equipment supply, plant maintenance, or ancillary mining activities, often used by companies like Hindustan Copper Limited.

EPC and O&M Contracts

EPC (Engineering, Procurement, Construction) contracts cover the design, supply, and construction of mining and processing facilities. O&M (Operation & Maintenance) contracts govern the ongoing operation and upkeep of mines and plants.

Toll Smelting Agreements

In these contracts, a smelter processes copper concentrate on behalf of a third party for a fee, returning the refined copper to the owner or selling it on their behalf.

Licensing, Permitting, and Regulatory Contracts

These include agreements with government authorities for mining rights, environmental permits, and compliance with statutory obligations.

Importance of Long Term Contracts

Long-term concentrate contracts play a foundational role in the global copper trade, particularly between copper miners and smelters. Their primary functions and impacts include:

Supply Security: Smelters rely on long-term contracts to secure a stable, predictable supply of copper concentrate, which is essential for continuous operations. This is especially important in a market often characterized by supply tightness and logistical disruptions.

Price Benchmarking: The terms (especially the Treatment and Refining Charges, or TC/RCs) set in major long-term contracts—such as those negotiated annually between large miners (e.g., Antofagasta) and major smelters (e.g., Jiangxi Copper)—serve as global benchmarks. These benchmarks influence the pricing of a vast number of other contracts, both long-term and spot, across the industry. The results of these negotiations are closely watched and widely adopted as reference points for subsequent deals.

Risk Management: Long-term contracts help both miners and smelters manage price and supply risks. By locking in volumes and pricing mechanisms (often linked to global indices), both parties can plan production, investment, and hedging strategies with greater confidence.

Market Stability: The prevalence of long-term contracts supports stability in the copper supply chain by reducing dependence on the volatile spot market. This is particularly important during periods of market disruption or when spot prices and TC/RCs fluctuate sharply.

Financial Planning and Investment: These contracts provide the revenue certainty needed for miners and smelters to make long-term capital investments, such as mine development or smelter upgrades.

Influence on Downstream Markets: The terms set in long-term concentrate contracts can also impact the pricing and negotiation of downstream products, such as blister copper and copper cathode.